ASHEVILLE, N.C. (828newsNOW) — Buncombe County officials are urging residents to pay their 2025 property tax bills by Jan. 5, 2026, to avoid penalties and interest.

Property tax bills were mailed in August and were originally due Sept. 1. Residents who have not yet paid are encouraged to plan ahead, especially with winter weather and holiday closures approaching.

Key dates for 2025 property taxes:

- Aug. 2025: Bills mailed

- Sept. 1, 2025: Original due date

- Jan. 5, 2026: Last day to pay without interest

- Jan. 6, 2026: Interest begins accruing on late payments

Payments can be made online, by mail, in person, over the phone or at a drop-off box. For mailed payments, the postmark date from the U.S. Postal Service determines the date received. Payments metered by third parties are not considered postmarked by the USPS.

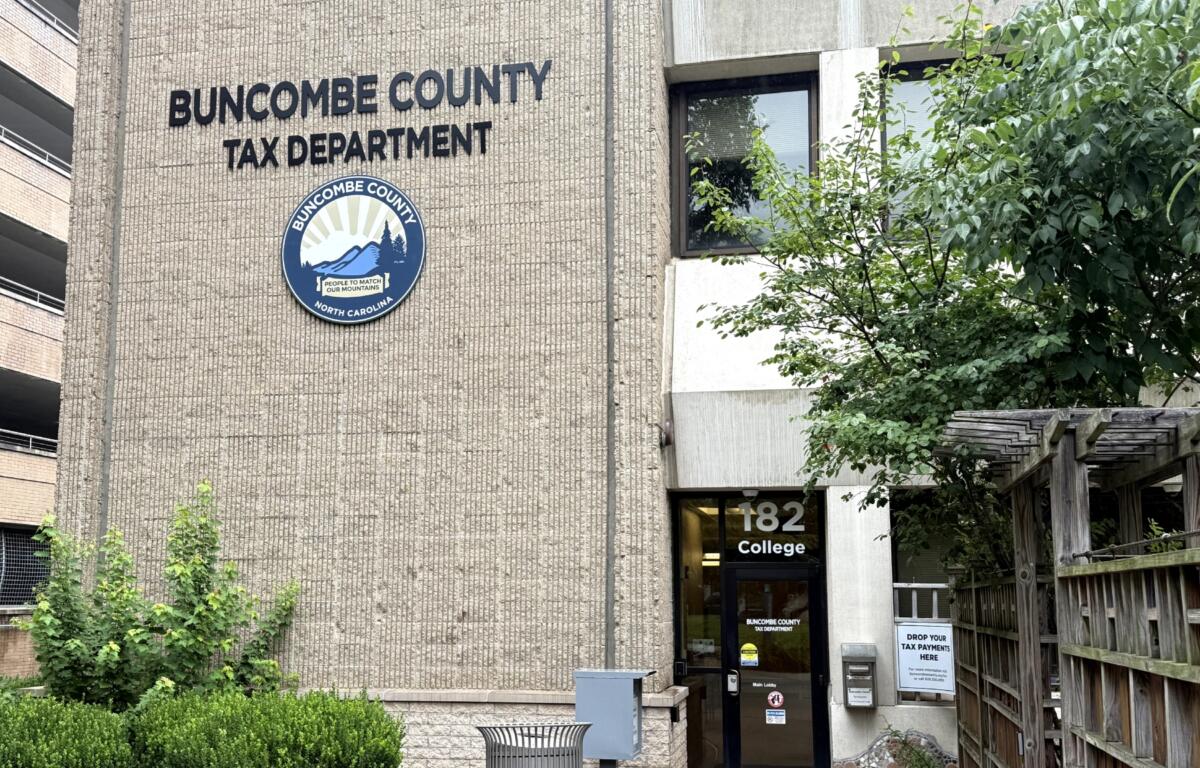

In-person payments can be made at the Tax Department’s new location at 182 College St. in downtown Asheville, between TD Bank and the County parking deck at 164 College St. Parking validation is available for those using the county deck. The office will be closed for the winter holidays Dec. 24-26 and Jan. 1.

Credit and debit card payments include processing fees: 2.35 percent for credit cards and $3.95 for debit cards. These fees are collected by the payment processor, not the County.

Buncombe County is currently conducting a general reappraisal, with new assessed values reflecting current market rates taking effect in January 2026. Questions about reappraisal can be directed to the Property Assessment team at (828) 250-4920 or online at buncombenc.gov/myvalueBC.

Residents can also use the County’s property tax lookup tool at tax.buncombenc.gov to view bills, review home data, file appeals, check comparable home sales and access information on tax relief programs for veterans and the elderly.

For additional assistance, contact Buncombe County Tax Collection at taxcollection@buncombenc.gov or call 828-250-4910.